Paying for car fixes with auto repair loans sounds like a good idea. But with just any good thing that exists today, negative circumstances are an inevitable part of it.

Even the most attractive terms don’t make paying for them any easier. Yet, if you need $500 for a new alternator or $4,000 for the entire transmission, auto fixing financing is a more hands-on approach.

No matter the reason why you opt for car mending loans, your task is to learn your options available on the market before getting deeper into it. All in all, vehicle breaks are always something unexpected.

That’s no wonder that 1 in 3 U.S. drivers opt for financial help because they can’t pay for an unexpected expences without going into debt.

A good rule of thumb having enough savings to pay for a $500 emergency is always smart. That’s likely to be a longer-term goal to aim for. Yet, for 63 percent of Americans having savings for emergency sounds more like a dream, unfortunately.

In a dream world, to avoid surprises down the road, you’ll have the budget for monthly payments and the inevitable expenses of routine maintenance and repair. Yet, the reality of the situation is much worse. Things happen when we are less ready. And indeed, with no money saved for this case.

So, here’s a question: ‘How to pay for car repairs with no money?’ Let’s learn, not guess.

How Much Have Finance Costs Drive Increased

Often when it comes to a vehicle break, we don’t escape the thought of getting a new car. Indeed, after purchasing a home, buying a vehicle is probably a consumer’s second-biggest expense. Yet, if this is your case, take into consideration the following.

Finance charges rose more sharply in the last twelve months than any major expense associated with owning a vehicle, said John Nielsen, AAA’s managing director for Automotive Engineering.

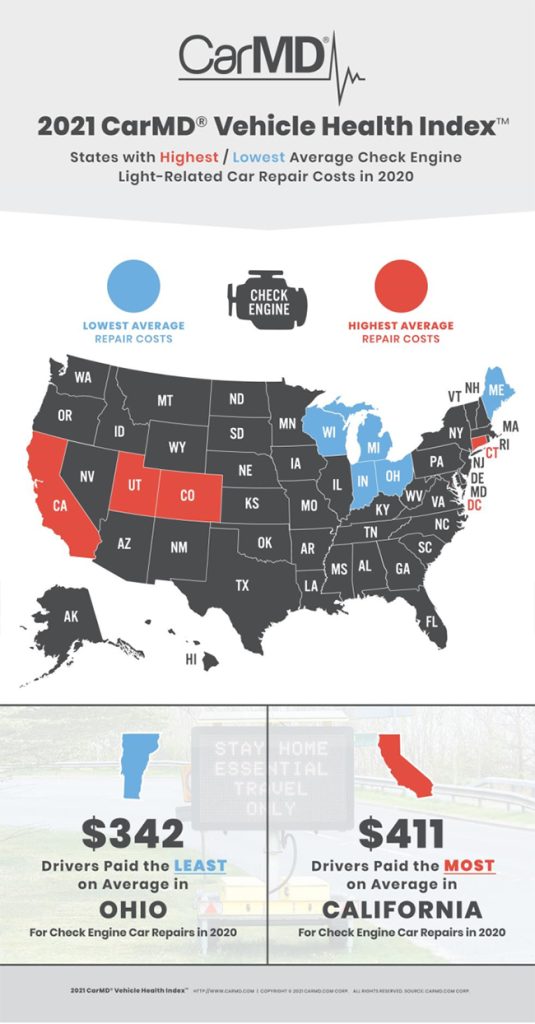

Average total car fixing cost is $400, but is vary by states of America.

How to Pay for Car Repairs with no Money

Before we start, here’s one thing to remember: auto repair loan is not a bed of roses. It can be a big expense, so think of it as you do of other big expenses. Even though the number of creditors ready to lend you abounds, no guarantee that all of them are going to be right for you or your financial future.

Far not all lenders and loans are alike. In times where some of them offer more questionable payment options, others come with high-interest rates and fees. So, you need to learn the rules of the game before taking part in it. Downsides are sure to come and you need to carefully weigh.

On the flip side, when you’re in the situation when such a loan is your only way out, go for it. If you don’t have money already put away for emergencies like this, there’s no time to wait.

Get the money you need, as soon as you need it and get back on the road quickly.

When you start learning your options, don’t shy away from getting a car fixing financial assistance. Getting help is never a bad idea. Instead, it can be your sure-fire way to pick the right option that can save you the day.

When it comes to auto mending loans no credit check, your buffet of options is not as long as you might want. Typically, loans for car repair are personal ones and can be either secured or unsecured. If unsecured, reputable providers will do soft credit reviews to determine the amount for which you qualify. Also, they do it to reduce the risk of loss through default.

A secured auto loan requires collateral. In case you qualify up to $35,000 take care of your score. It needs to be at least outstanding. While those with bad ones will end up with even more options available.

Auto Repair Loans for Bad Credit

Source: Pexels.comThe good thing is you can get this type of loans even with bad credit. It’s not all that difficult as you might think.

But there’s a catch: you need to demonstrate you have a regular and reliable income.

That’ how car repair loans for bad credit work. Most lenders put more weight on your income than on your score. And if you are the one who matches their requirements, half work is done.

The beauty of loans for car mending is you can use it for any purpose like battery, damage, oil change, or car door paint. If you have a good score, chances are your interest rate will be more attractive in comparison to the one with a bad score. Once approved, the money you need will be deposited into your checking or savings account within 0 to 3 business days.

Emergency Car Repair Loans

Your life doesn’t stop after a car accident. Without a doubt, it can dampen your spirit, yet, there is a way out.

With 86 percent of Americans driving to work every day, having an alternative for financing car fixes is always great.

Indeed, if you have insurance, chances are you can get away with it. You won’t pay the full cost of mending but you still need to reach the deductible.

In turn, these loans will ensure you stay within the budget. As a result, you get fixed monthly payments and a low-interest rate. Bad credit auto repair loans are sure to be higher, yet they can help keep you from adding credit card debt.

Some companies offer special credit cards to their customers in case of car emergencies. Sounds like a good idea? Well, that’s not all that easy. With this lending solution, you risk to end up accumulating more interest that you must pay. So, in case of emergency, it’s better to stick with loans for auto repairs, which come with the benefit of set term limit.

How to Find a Good Deal on Loans for Auto Repair

Before you begin to shout out loud ‘I can’t afford my car repairs’, there’s a better idea. There are some things you can do to save time. And what’s time? Time is money, of course.

So, first – ask questions.

We often follow people’s advice without proving the contrary. This time, think on your feet and don’t accept what’s been said. Even if this information was from your closest friend or relative. Your financial situation is unique, even if it seems like the same. Instead, do your research. Ask for details. Once you totally understand what has to be done, you can make the second step.

Lenders who offer car repair loans no credit check won’t probably going to report your loan or timely payment to the credit bureaus. If you think that’s great, think again. Every loan you take impacts your score. This time if you apply for this type of loan, it means it can’t be used to raise your score. Bad idea for those who work towards increasing their credit score.

Fair Car Repair Loans: Do They Exist?

As you do research, a fair loan from a reputable lender might offer as many benefits for you as possible.

Here are some things to consider when looking for vehicle fixing loans:

- Affordable Monthly Payments

At a time when you need the extra support, the day of your paycheck doesn’t need to stop you from getting a loan to fix a car. You need to find a lender who can help get your car services right today and pay for it over time. If a lender can also offer competitive rates and low payments, it makes sense to consider it.

- Flexible Payment Options

A good loan for car repair is definitely the one that works for you. Depending on your income and different payment timelines, find the one that matches your terms. Indeed, you may want to improve your credit, so it’s in your interest to pay your lender on time. As a result, you won’t get any penalties and see your credit score raise.

- Easy Peasy Application Process

In a digital world, we live in, every second matter. People go online to find the solution to their problem in as fast time-period as possible. That’s where modern digital devices come into handy. The same with loans to fix a car.

The application process that takes just minutes to fill out could be a perfect choice for you. Of course, you’ll have to place your personal information such as your name, phone number, your income, and the like. But 20 fields of demographic information will probably turn you off.

Way to Go When You Need Money for Car Repair

So, you need a loan for auto emergencies. It’s not the time to dampen our spirits. Instead, it’s time to act.

When it comes to borrowing money, a lender that is honest, transparent and fair needs to be high on your list. It should be an expert in the lending industry in general, not only the auto niche. Privacy and security are the top priority for reputable lenders.

Even if you have several lenders in mind, it’s never a bad idea to look for more. PayDay Say can definitely surprise you with offers.

No one should impact your decision, of course, but comparison shopping is always smart. Especially when it comes to the money you don’t have at the moment. So, ask questions. All in all, it’ll cost you nothing but can save the day in the future.

SSL protection & encryption

SSL protection & encryption